A CHALLENGING QUARTER – CONTINUED FOCUS ON INVESTMENT FUNDING

Latest News

Subscribe for latest press releases

A CHALLENGING QUARTER – CONTINUED FOCUS ON INVESTMENT FUNDING

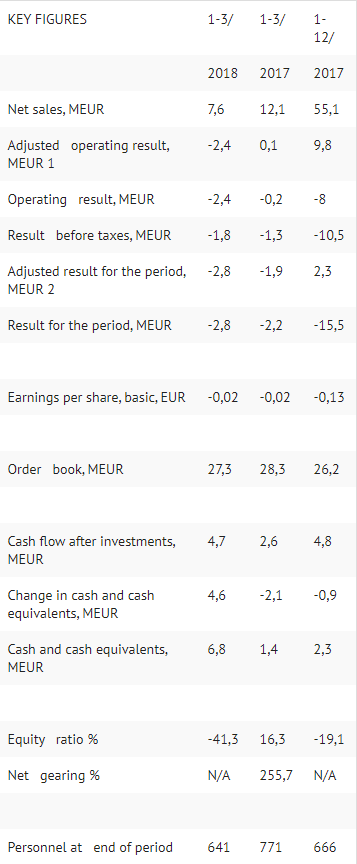

1) Adjusted operating result = operating result before one-time items.

2) Adjusted result for the period = result for the period before one-time items.

Unless otherwise stated, all figures presented below are for the review period 1-3/2018 and the figures for comparison are for the corresponding period 1-3/2017.

CEO Padma Ravichander:

“The financial result of the company for January-March 2018 was below expectation while the net cash inflow position improved.

At the top level, we reached the revenue of EUR 7.6 million, which is 52% lower than in the previous quarter and nearly 38% lower than the same quarter in 2017. Our first quarter revenue is typically lower than for other quarters because of the internal budget process at customers.

The revenue in Project was very low compared with the corresponding period last year based on the public tender offer process, which caused our customers to withhold their orders.

The revenue in Maintenance & Support was EUR 6.5 million (EUR 7.9 million). The decrease was mainly due to exchange rate changes, a maintenance discount, reduced value of maintenance in Southern America and implementation of IFRS 15. We have retained the Maintenance & Support service of our current customers, while not being able to get major new orders for projects.

The order book at the end of the period amounted to EUR 27.3 being approximately at the same level than the year before (EUR 28.3). The new orders received during the first quarter were quite low at EUR 8.6 million, i.e. almost half of the same in last year same quarter. The major reason for this was the public tender offer, because of which the customers were waiting for the process to come to a conclusion.

While the revenue was falling, we were quick enough to ensure that the costs were contained. The employee costs came down by 25% and the overall operating costs were down by 18%. With lower financial expenses - both one-time and other expenses - the net income for the quarter was EUR -2.8 million against EUR -2.2 million in the same quarter in 2017.

Prospects for the future

After the cancellation of the public tender offer, we continue to seek new investment to address the ongoing concerns on our financial position. Finding a solution in financing would help us get the order book and sales back on track, as there are multiple opportunities in the pipeline for our Digital commerce, BSS Stack in new markets, among others.

Our operating environment still is challenging. We operate in countries facing exchange problems, and we also are dependent on a few major customers. The uncertainty related to the completion and timetable of Offeror’s tender offer resulted in delays in order intake. However, our Maintenance & Support revenue continues to be stable and has significant committed ongoing orders.

In order to balance the financials of the company, we will continue our ongoing exercise to optimize and lower costs.

Our major preference today is to continue efforts for finding a durable solution for financing so that we can ensure the company’s stable operations and further development.”

PROSPECTS IN 2018

The liquidity of the company is extremely tight and the financial situation and liquidity are critical. The company continues seeking long-term financing, which could be implemented through company or restructuring arrangements. The company also continues reducing operational costs further. The company’s ability as going concern is dependent on the successful completion of getting new financing. Negotiations are on-going and will be continued.

Tecnotree does not provide an estimate for full year 2018 due to several uncertainty factors having impact on customer investments.

TECNOTREE CORPORATION

The Board of Directors

FURTHER INFORMATION Padma Ravichander, CEO, tel +97 156 414 1420 Kirsti Parvi, CFO, tel +358 50 5174569 www.tecnotree.com