Tecnotree corporation half year report 1 Jan - 30 Jun 2019 (Unaudited)

Latest News

Subscribe for latest press releases

STRONG HALF YEAR RESULT – PROFITABLE GROWTH CONTINUES

Second quarter

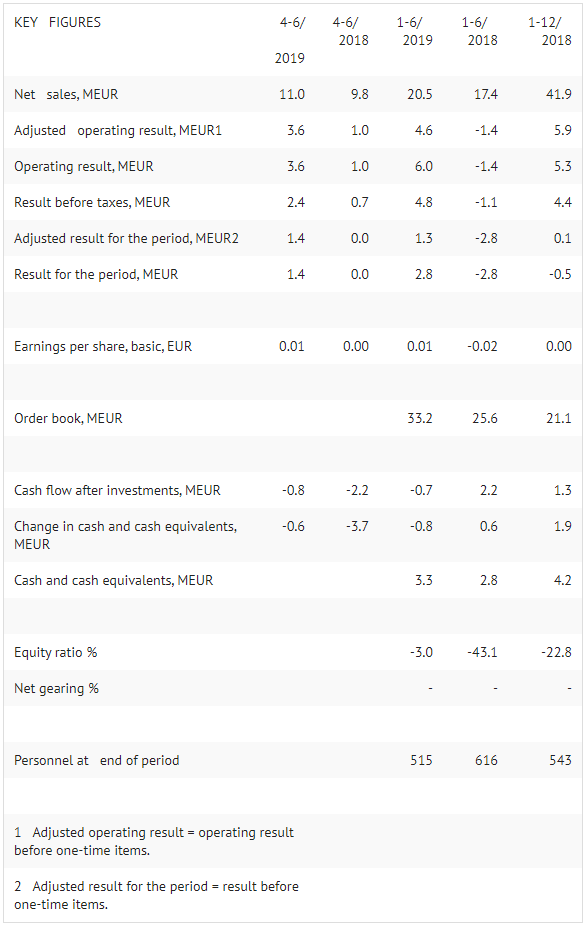

- Second quarter net sales were EUR 11.0 (9.8) million.

- The adjusted operating result for the quarter was EUR 3.6 (1.0) million and operating result EUR 3.6 (1.0) million.

- The adjusted result for the quarter was EUR 1.4 (0.0) million and result EUR 1.4 (0.0) million.

- The order book at the end of the period stood at EUR 33.2 (31 December 2018: 21.1) million.

- Second quarter cash flow after investments was negative EUR 0.8 (-2.2) million.

- Earnings per share were EUR 0.01 (0.0).

January-June 2019

- Net sales for the review period were EUR 20.5 (17.4) million..

- The adjusted operating result was EUR 4.6 (-1.4) and the operating result EUR 6.0 (-1.4) million..

- The adjusted result for the period was EUR 1.3 (-2.8) million and the result EUR 2.8 (‑2.8) million..

- Cash flow after investments for the review period was negative EUR 0.7 (2.2) million and the company’s cash and cash equivalents were EUR 3.3 (31 December 2018: 4.2) million..

- Earnings per share were EUR 0.01 (-0.02).

CEO Padma Ravichander:

From the CEO’s Desk - “On Track Performance Quarter on Quarter”

I am happy to report that the Company continued its on-track performance this quarter. The last few quarter results have shown that the Company has focused on the right priorities and has demonstrated growth inprofits, while increasing the topline. While improving the revenue growth has been our priority, we are equally focused on delivering the highest quality of service to our clients, optimizing our costs globally and thereby ensuring profitable growth.

Revenue

This quarter continued the trend of revenue growth. The revenue of EUR 11.0 million is 15% higher than the previous quarter of EUR 9.5 million and 12% higher than that of the same quarter in the last year, adequately demonstrating the growth trajectory in the revenue.

All the regions, except APAC, witnessed growth in revenue. The growth in the MEA region, which constitutes largest share of revenue, witnessed a very strong growth of 37% over the previous quarter.

The other aspect of the revenue growth is the growth in the product revenue. The non-maintenance revenue, which was 20% of the total revenue in the same quarter last year, increased to 35% in this quarter, which further demonstrates that the company’s transformation into becoming a truly digital product company is gaining good momentum.

One of the priorities of the company is to ensure organic, structured and steady growth. Ability to get new orders play a significant role in achieving this. During this quarter, the order intake reached EUR 21 million, which is nearly double of the previous quarter. This was also facilitated by an agreement Tecnotree signed with one of the largest telecom operators of the Middle East Region to accelerate the Digital Transformation of their Business Support Systems using our Tecnotree Digital BSS 5 Suite of products. The agreement is valued at USD 15.8 million over a 2 years period. Under this agreement, Tecnotree will deploy its entire Digital BSS Suite 5 products to help accelerate the operator’s business growth and new digital services to the market, It will also help increase agility & operational efficiency of their IT systems.

Winning new logos is one of our top priorities at Tecnotree for 2019 and in this half year, I am proud to announce a Tier 1 operator, Telefonica, Peru chose Tecnotree’s digital accelerator platform (DAP) and service delivery platform (SDP) to replace their existing middleware (responsible for service orchestration) in order to rapidly accelerate their digital transformation and virtualization journey. Based on a simplified and reliable architecture, Tecnotree’s solution will provide a new OTT offer enabler for digital services serving fixed and mobile subscribers.

Costs

We continue our focus on cost optimization, which we believe is an ongoing exercise and needs close attention and continuous realignment. The operating expenses were down by 16% compared to the same quarter last year and were down by 14% compared to the previous quarter. We will continue to monitor the costs closely and ensure optimal utilization of our resources. We are also cognizant of the fact that while the cost controls are important, such measures should not impede Tecnotree’s growth and R&D trajectory.

Profit

As a result of sustained growth and tight management of costs, the company was able to achieve an EBIT of 3.6 M Euros, which is 33% of the Revenue. This is significantly higher by 50% of the EBIT reported last quarter and 260% of the EBIT of the same quarter last year. The Taxes and Exchange losses continue to have a significant impact on our overall profitability. This is mainly due to the geographies we work in and the local legislations and regulations with regards to Withholding Taxes (WHTs). We are continuously exploring the possibility of minimizing these expenses as we move forward.

Other Business Updates

Tecnotree continues its strong position to grow its business across global markets, by increasing the presence of our brand and taking advantage of the onset of 5G implementations and the digital transformation requirements of our customers. We hope to synergize new partnerships with other internet of things (IOT) providers, to increase our competitive edge, our reach to new markets and to strengthen our customer base globally, so that our customers may benefit from the full range of the state-of-the-art, Tecnotree Digital BSS Suite 5 products and our high quality digital Deployment, Operational and Managed Services capabilities.

RISKS AND UNCERTAINTY FACTORS

The risks and uncertainty factors for Tecnotree are explained in the 2018 Board of Directors’ Report and in the notes to the Financial Statements. Tecnotree’s risks and uncertainties in the near future relate to financial risk, availability of funding and sufficiency, projects, to their timing to collect trade receivables and to changes in foreign exchange rates. Having sufficient cash funds and the development of net sales are the most significant risks. Risks related to having sufficient cash funds and financing have reduced after Fitzroy Investments Ltd and Luminos Sun completed their investments as per the subscription-based agreement signed by them with Tecnotree in September 2018. The total subscription price received by the company during the review period was EUR 2.91 million. At the end of June 2019, the Group’s shareholders’ equity stood at EUR 1.0 million negative.

EVENTS AFTER THE END OF THE PERIOD

On 1.7.2019, Tecnotree announced the appointment of Priyesh Ranjan as Chief Financial Officer of Tecnotree and his resignation from the Board of Directors of Tecnotree.

PROSPECTS IN 2019

The company strengthened and stabilized its operations in 2018, and in 2019 the company continues with the efforts to improve its net sales while focusing on profitable growth.

TECNOTREE CORPORATION

Board of Directors

FURTHER INFORMATION

Padma Ravichander, CEO, tel +971 56 414 1420

Priyesh Ranjan, CFO, tel +971 50 955 1188 www.tecnotree.com