Wallet capabilities that completely digitized payments for corporate customers

Wallet capabilities that completely digitized payments for corporate customers

Digital transformation is gaining steam in the Middle East. A McKinsey and Company survey recently revealed that 58 percent of consumers in the region prefer digital payment methods while just 10 percent preferred cash. Digital wallets and ecosystems are set to become the most influential payment method. However, organizations seeking to digitize payments face roadblocks. Legacy technology, clunky user experiences, and a lack of cohesion between onboarding and operations compound existing issues with bill payments. This scenario was playing out with our client, a Tier One communications company in the Middle East.

Digital payments have gone mainstream

E-wallet has become a great potential in the e-commerce market and takes a larger share of the payments pie. Juniper Research forecasts that the value of global e-wallet transactions will exceed $10 trillion by 2025, up from $5.5 trillion in 2020. E-wallet providers, both original equipment manufacturers such as Apple Pay, Starbucks, Google Pay and Samsung Pay and mobile money wallets such as M-Pesa in Africa are seeing growth.

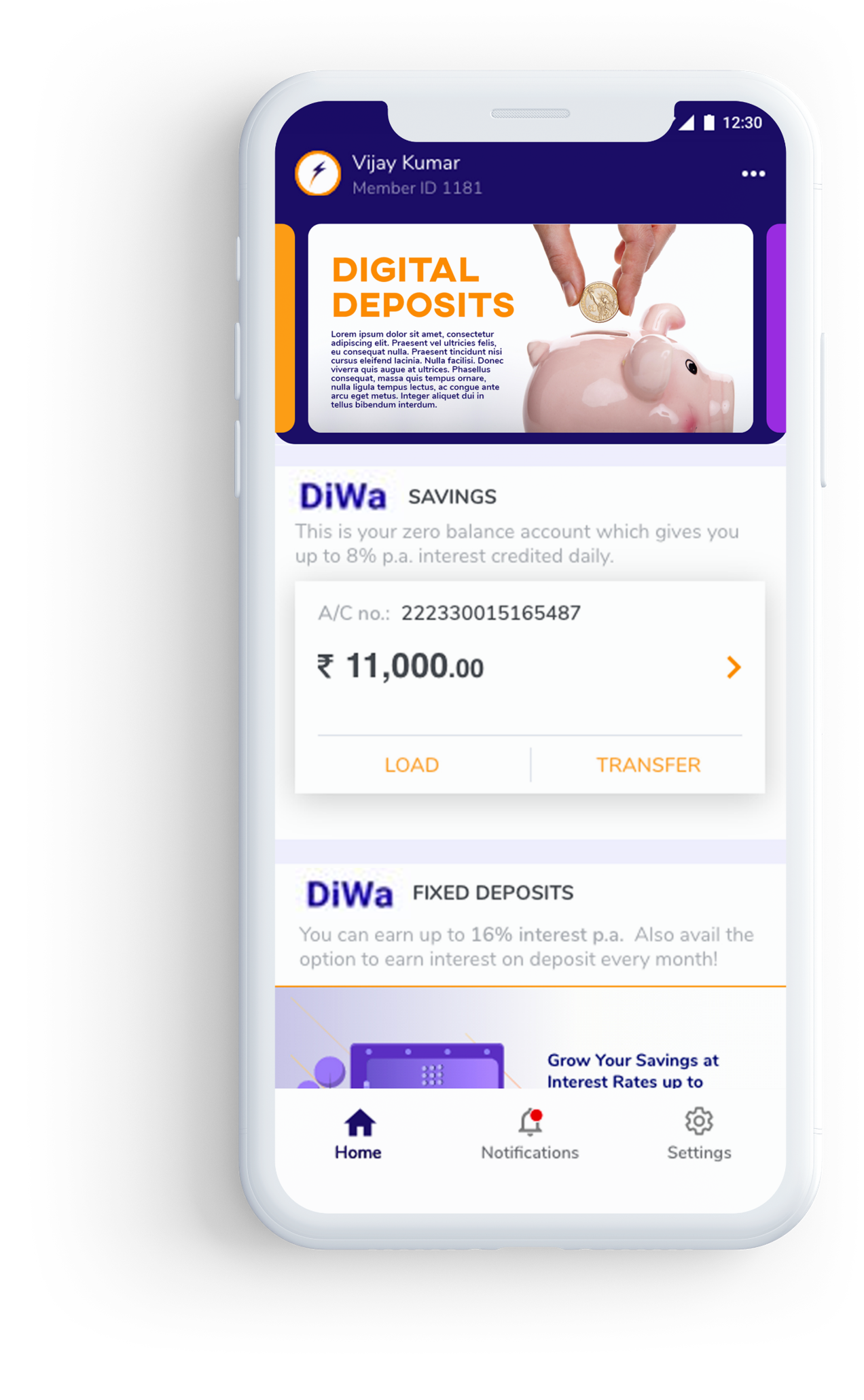

DiWa — Intelligent Wallet from Tecnotree

We help telecom operators and financial institutions achieve long term profitability in mobile financial services and commerce by building an intelligent wallet and self-sustaining ecosystem. By creating a Digital Payments ecosystem spanning B2C and B2B customers we are wellpositioned to help pave the way for a digital economy.

Merchants evolve their payment offerings in the face of rising customer expectations, and ongoing business and technological challenges.B2B merchants are prioritizing investment in digital payments that will provide a better customer experience. Those that meet evolving customer expectations will garner stickiness and loyalty with customers, enjoy cost savings, increased revenue potential and better cash flow.

How DiWa’s Wallet capabilities completely digitalized payments within an ecosystem encircling B2C and B2B customers

Many operators are transforming themselves to cope with new market conditions. There is so much taking place on the retailer and banking fronts, operators cannot be too far behind. Operators are fast progressing on payments to include wallets to vie for a bigger share of the mobile payments pie. Mobile wallets are a superb way to enhance customer loyalty. Apart from exploring HCE technology, telecom operators use data pertaining to a customer’s mobile and mobile wallet usage to offer relevant products and promotions. In the Middle East as digital adoption accelerates, new government regulations and future-driven global payment providers, are bringing rapid change. The move to cash is evident not only in the growth of digital payments but in consumers’ expressed preferences.

The Client

Our client boasts a customer base of 2.5 million, spread across B2B and B2C sectors. Their primary offerings target B2C markets. However, the company offers relatively simpler products to B2B clients.

Despite this simplicity, our client routinely encountered issues with their payment workflows. Here are some of the problems with which our client was dealing regularly. Error-filled bill payment systems when serving corporate clients, poor digital payment solutions, and a lack of digital onboarding solutions were some of the issues that routinely cropped up.

These errors delayed payments and led to poor user experiences. Additionally, siloed data created by legacy systems meant employees in customer-facing roles lacked insight into issues. Overall, customer experience was poor and our client faced multiple roadblocks addressing these problems.

These challenges compounded to create further risks that were jeopardizing the business. Some of these risks included:

Increased customer disputes due to error-prone bill creation

Reliance on manual payment workflows that created more errors

Late payments, penalties, and more resources directed toward customer disputes

Lack of digital dashboards increasing fraud risks

Lack of customer insight leading to demoralizing employee and user interactions

Risk of losing larger customers (such as Microsoft and Netflix) to competitors

A reliance on archaic technical systems was the culprit. These legacy systems created data silos, leading to some parts of our client's organization relying on different datasets than others. These silos hindered communication, leading to customers experiencing disjointed interactions with different team members.

An end-to-end digital solution was the need of the hour. A lack of cohesion within payment pointed to larger issues, such as the lack of a digital partner management system, risk-based ticketing, and poor collection practices.

After an in-depth analysis, we concluded that the DiWa Intelligent Fintech Platform was the perfect solution for our client's needs

THE CLIENT NEEDS

- Comprehensive digitalization of payments and payments collection system

- End-to-end digital partner management system with partner catalog and commissioning

- Digital trouble ticketing for both B2C and B2B customers

DiWa Intelligent Fintech Platform

Our Solution

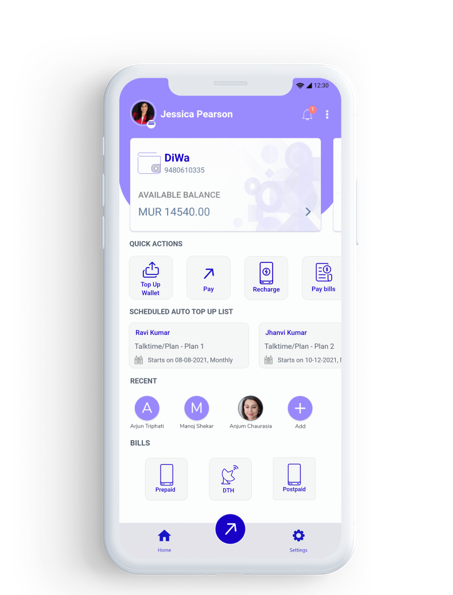

The DiWa Intelligent Fintech Platform helps Banks, Financial Institutions digitize B2B and B2C payments. In addition, our platform helps communication service providers offer bundled products to their customers through a partner marketplace. Our platform offers two distinct apps: The Intelligent Wallet SuperApp and The Digital Banking SuperApp.

Intelligent Wallet Super App

- Digital customer onboarding - B2B, B2C, and B2B2X

- Digital payments - P2P, domestic and cross-border remittances, contactless payments, virtual cards, and merchant payments

- Microlending

- Loyalty and rewards programs

- Partner marketplace

Digital Banking SuperApp

- Digital customer onboarding

- Omnichannel experience

- Agency banking

- Loyalty and rewards programs

- Partner marketplace

- Personal financial management

Given our client's unique needs, we upgraded their workflows using our Intelligent Wallet SuperApp. The Corporate Wallet helped our client automate bill payments, connect customer profiles to receivables data, accelerate collections, and create robust reconciliation and settlement reports. Our client could now link customer onboarding to accounts receivables, giving them a centralized picture of payment statuses. Customer-facing teams could draw from these data to offer clients a better experience through informed communication. However, we went a step further and upgraded our client to the Merchant Partner Wallet along with the Partner Management Solution. Adopting these solutions helped our client create self-directed onboarding processes for their digital partners. Contracting workflows were digitized, enabling the creation of a digital product catalog. A side-effect of going digital was that product bundling was simpler, giving customers access to more options. Invoice generation was automated, as was order tracking and fulfillment. Employees could spend more time addressing major issues that added value to the company, instead of following up on clerical work.

“Telco service providers are participating meaningfully in emerging ecosystems by facilitating commerce and harnessing the real opportunity in 5G. The spread of 5G mobile network coverage suggests that over 160 communications providers worldwide now deliver some form of 5G service.”

-General Manager Product Marketing

The Results

One of the immediate benefits our client realized was speedy onboarding. A process that used to take hours shrank to a few minutes. In addition, our client could execute multiple onboarding workflows in parallel. Attractive product bundles were a staple of a highly-engaging partner ecosystem that delivered maximum value to new and existing customers.

Most importantly, our solution enabled greater B2B2X ecosystem, opening the doors for more interaction between B2B merchants and their B2C clients.

From an operations perspective, our client realized the following benefits, through full digitization:

Better

audit trails

Seamless internal communication

Better customer status visibility

Reduced fraud risk

Better CX through self-service onboarding

Greater ROI from resource allocation

The Conclusion

Digital transformation is in full swing in the Middle East as more companies adopt electronic workflows. Thanks to our solutions, our client instantly upgraded their infrastructure, giving them better insights into customer needs.

While operational benefits such as reduced fraud risk and intelligent resource allocation left a huge impact, the biggest advantage was delivering a great customer experience.

The bottom line: Our client has an edge over their competition and is well-positioned to deal with any disruptions that might occur in their industry.

Tecnotree - A Finnish Partner of Futuristic CSPs and Financial Institutions since 1978 helps clients accelerate top-line growth, stay ahead of the competition and set new benchmarks for business processes. Tecnotree is present in 70+ countries, works with 90+ customers, 900M+ subscribers, >70% certified employees. www.tecnotree.com/products.