Telecom and Fintech Convergence

Telecom and Fintech Convergence

Digitization today is transforming the lives of people in all aspects around the globe. As the industries are going through digital transformation, the digital payments industry has also evolved and has shown significant and steady growth in terms of both volume and value of transactions. The disruption in the financial services sector has been a huge contributing factor in the development of economies in various aspects. Telecom 5G and other emerging technologies will converge to provide faster, cheaper, and better services for more people that did not have access to these services before. We might as well see that it will be digital fintech services that will drive 5G and not the other way.

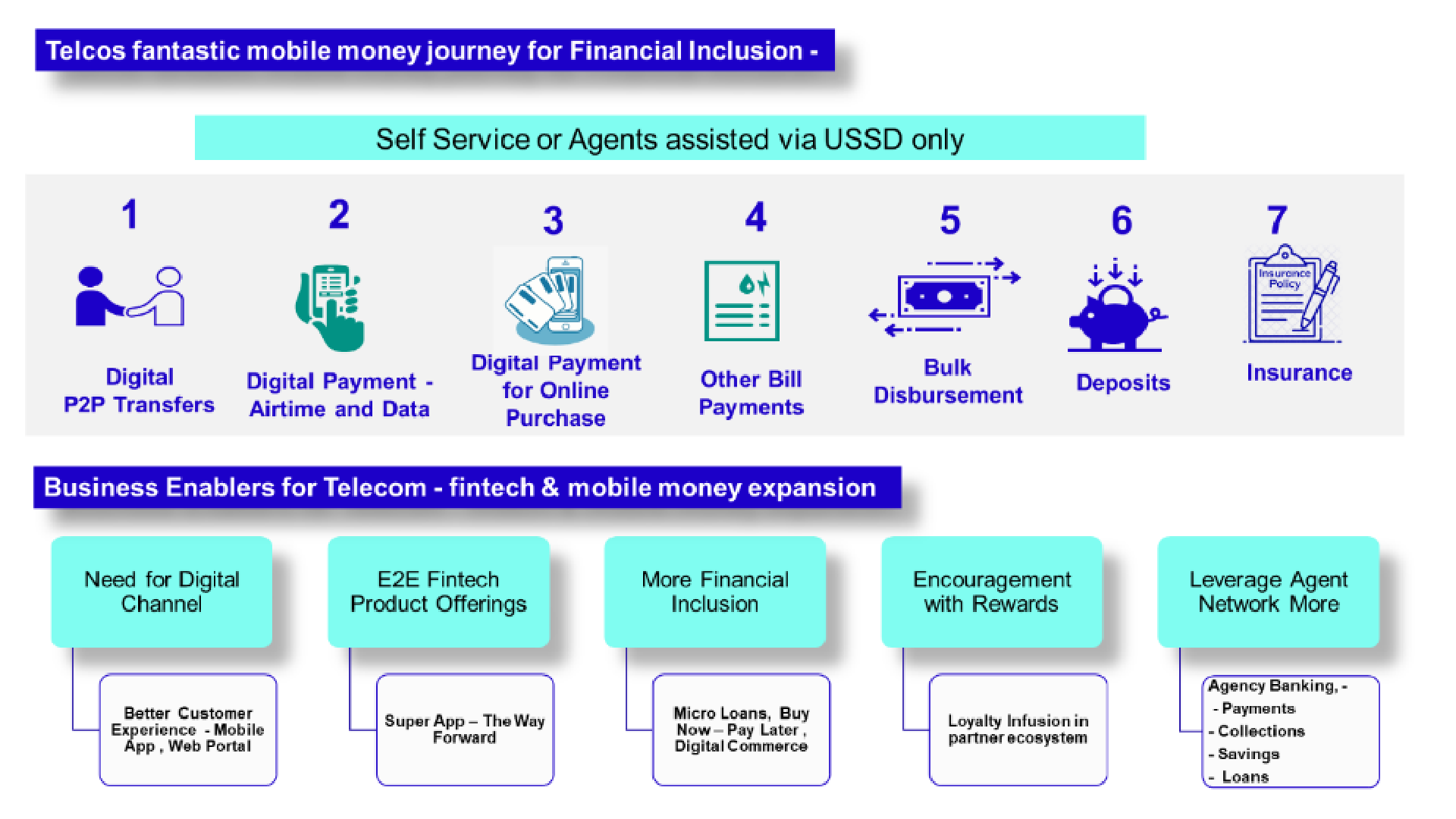

Telcos have a strong, trusted brand presence, an established nationwide infrastructure, and a large and secure customer base. Many of these customers are based in rural areas and have limited or no access to banks, ATMs, or the internet. Innovative technologies on the fintech side enable the delivery of small micropayments and other services to individuals who can now benefit from credit access, payment portals, and insurance. Telcos through mobile money, have enabled financial inclusion within unbanked communities which have struggled to access banking services. The USSD-based solution is the most popular channel in some markets however in emerging markets mobile apps are the preferred channel as the middle class has been growing in spending power. Telecom connectivity is improving with the evolution of 3G /4G/5G networks. This shows an increase in purchases from vast untapped pools for payments companies through mobile wallet applications because mobile phone penetration in these regions tends to be high.

There has been a shift in mindset amongst telcos about the acceleration of digital banking globally providing an opportunity for telco companies to take a more active role in financial services, and telcos are gearing up for the possibility of delivering digital banking solutions offerings while leveraging core capabilities of the telco. Telcos as service providers have realized that such financial services are helping generate revenue and building brand loyalty for them. For example, Telcos in Africa have established financial services, such as mobile payment platforms which continue to evolve and expand, and the fintech customer base & revenue for leading telcos in the region is growing with fintech business contributing a significant percentage of group service revenue.

Telcos typically have not offered a full suite of financial products due to a common problem for telcos and for banks – “how to leverage the vast pools of data they sit on?” Historically this problem could not be solved, but as the scenario is changing telcos are willing to partner with banks and fintechs to collectively add value for their customers. As a result, telcos are focusing on adding more fintech products like Savings & Deposits, Micro-Lending, Buy Now – Pay Later, Micro-Insurance, and Digital Commerce offerings by designing a Super App to enhance customer experience every time they use the service, providing them with a simple, engaging, secure and convenient digital solution. Telcos and Fintechs also collaborate to deliver improved benefits that enable small businesses to grow. For start-ups and SMEs to access loan finance and access affordable business automation solutions, such as taking digital, contactless payments from customers, it is essential that they connect to the correct business tools offered by Telcos.

There is an ambitious attempt from Telco to become a “Techco”, with innovative Telecom and Fintech digital services. This convergence allows Telcos to consolidate telecom and fintech product offerings, leverage customer insights for contextual & personal campaigning for cross-selling, offer seamless customer experience, and accelerate the shift to mobile payments. With digital wallets being one of the most common payment methods globally, both online and in-store, this drives financial inclusion. Telecom 5G would make digital banking more efficient, we may see the rise of cloud-based neo banking & virtual banking which will be assisted through virtual tellers and virtual advisors avoiding physical bank branch setups which require huge capital & operational expenditure.

To provide services based on true Telco–Fintech convergence, there should be a platform that builds, manages, controls and delivers omnichannel Telecom & Banking experience to their customers. Along with voice, SMS, data, content services, etc., telco services should include fintech services like funds transfer, virtual cards, micro-loans, and m-insurance, available across various channels such as web, mobile, and even legacy channels such as USSD, and SMS. This enables a business to disburse a bouquet of online and offline (self and branch-based) services to its customers.

Successful fintech products in Telecom scenarios:

- Digital Payments - Auto recharge for Telco Prepaid services, and other bill payments.

- Credit Assessment and Microlending: Airtime credit for B2C or B2B/ Enterprise customers where AI-ML-based Credit scoring is dome based on telecom consumption behavior & other alternate data sources. Telcos also bring insights into their customer’s subscriptions & payment track records to ensure responsible lending to avoid financial exposure in collaboration with Micro Finance Banks.

- Savings, Insurance & Investment: Digital wallet-based Low KYC stored value accounts enable the customer to save and eventually invest when they have a surplus. While most insurance sales are still done in a face-to-face environment, the convergence of telcos and fintech will now introduce innovative new solutions that will allow lower-income earners with asset protection and insurance products through digital and mobile platforms. This will improve customer servicing and claims processes.

Riding high on the Fintech Offerings, Telcos are already posting a significant rise in profit. The relationship between fintech and telecoms is always complementing each other, as both industries work together to drive financial inclusion, innovation, and growth in the digital economy. The overall value proposition driven by telecom & fintech convergence drives the agenda of digital experience, accelerate time to market & new revenue streams - topline growth. The new expectations are growing, and we will see a convergence of digital fintech platforms, telecom - 5G for the best performance, and advanced technologies like blockchain, IoT, and advanced cybersecurity.

ABOUT THE AUTHOR

Sujit J. Chaudhari

General Manager – Solution Consulting

Sujit J Chaudhari is Tecnotree's leading Solution Consultant for Telecom & Fintech domains with 20 years of experience. Currently, he is promoting an initiative to provide standalone and convergent innovative solutions to Telecom and Fintech clients with AI-ML infusion.